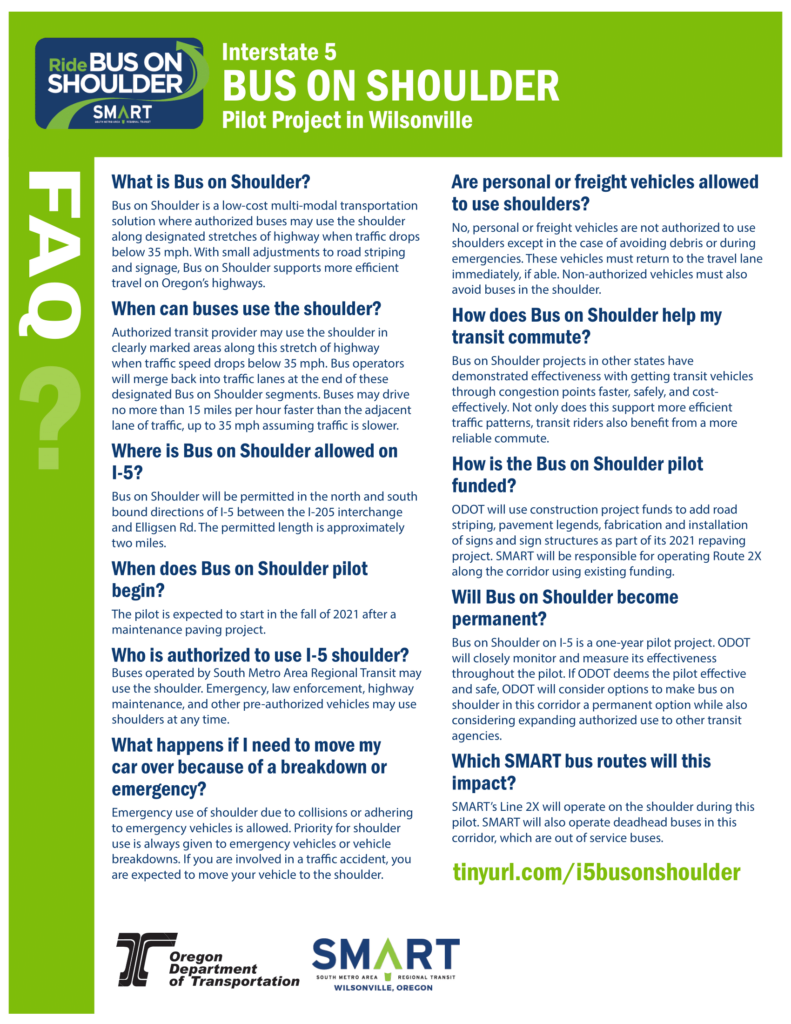

Bus on Shoulder Project

This Wednesday, May 26, Business Oregon will open the final portion of a program to provide grants for small businesses to help with commercial rent and operational costs in the face of the COVID-19 pandemic.

The Oregon Legislative Emergency Board allocated approximately $100 million for the program to help small businesses impacted by the pandemic and the restrictions it necessitated. Following two rounds of distribution of Commercial Rent Relief assistance grants, approximately $28 million remains to be distributed in this final round through the Operational Cost Assistance Grant.

The Operational Cost Assistance Grant is designed for businesses with 100 or fewer employees in industries that were particularly affected by the pandemic, including those that:

1. offer the consumption of food and or drink on premise;

2. provide… Read the rest

Who: Your organization and the students from the Tigard-Tualatin School District When: Wednesday, May 26 from 2 – 4 pm

Where: At the video conferencing link created by you*

We are looking for businesses and organizations that have jobs to offer Tigard and Tualatin students in the immediate future. The #WorkReady team will take your information and create a website where students can learn about you, the opportunities available, and drop in to talk with you during the virtual job fair. Let’s work together to bring local talent into our workforce and fill your jobs!

Sign up by May 19th to participate. … Read the rest

In recognition of Earth Day, Chamber investor, Swire Coca-Cola, participated in a SOLVE Oregon Spring Clean event at Memorial Park in Wilsonville. Thirteen associates volunteered for nearly 20 hours total collecting litter in the park and around the surrounding neighborhoods.

This is just a small part of Swire’s mission to achieve a world without waste. Swire Coca-Cola, has the goal of being the best corporate citizen everywhere they do business and we’re proud to have them as an integral part of our Chamber!

“The most significant issue of the past week was the final passage of the ‘American Rescue Plan’ federal aid package that will send over $2.6 billion to the Oregon legislature to fill budget holes.

With all this money coming to the state, OSCC sounded the alarm that the Oregon Legislature is still looking to raise taxes on small businesses and working Oregonians.

OSCC sounded the alarm on the following taxes:

OSCC also called attention to important tax relief legislation:

Finally, OSCC is looking to Friday, March 19th with a high degree of anticipation, as it is the first major deadline of the 2021 legislative session. All… Read the rest